nassau county tax grievance status

LOWER YOUR PROPERTY TAXES WITH MAIDENBAUM. The Assessment Review Commission ARC will review your application.

How To File For A Nassau County Property Tax Grievance Your Online Property Tax Grievance Center For Nassau County Long Island

At the request of Nassau County Executive Bruce A.

. Please enter your login information below. Its free to sign up and bid on jobs. 240 Old Country Road 5th Floor Mineola New York 11501.

We hope that youve filed your tax grievance as Nassau County is one of the highest taxed counties in the country. Nassau County Tax Lien Sale. Nassau county tax grievance status.

The local authorities typically rely on information in. The first step in the process is to file an affidavit with your county assessors office within six months after the assessment date on which the taxes are based or before June 30th if you have not yet received that notice. You then have until April 15th to.

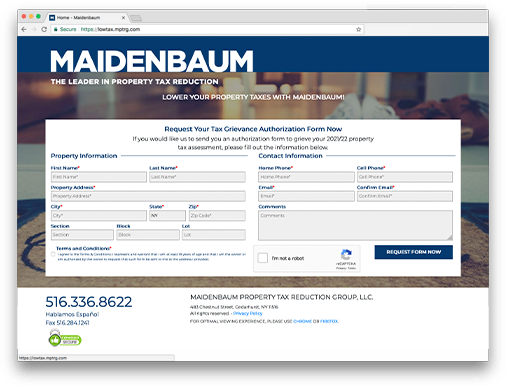

We will keep you posted on the status of your tax grievance and any change in the status of your case andor settlement offer from the County in a timely manner. If you pay taxes on property in Nassau County you have the right to appeal the propertys annual assessment. Search for jobs related to Nassau county tax grievance status or hire on the worlds largest freelancing marketplace with 20m jobs.

Appeal your property taxes. Please Login to Continue The requested page cannot be accessed without logging in. Nassau County Assessment Review Commission.

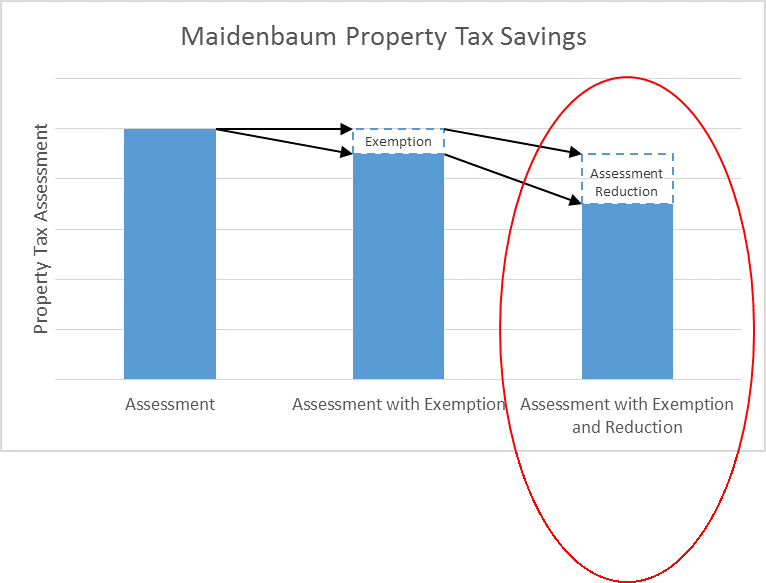

March 2 property tax rates in new york especially in suffolk and nassau counties are among the highest in the nation. For the 20232024 tax year a successful assessment reduction may be reflected in 3 possible ways. Deadline for filing Form RP-524.

PAY MY BILL GET STARTED. How to File an Appeal Using the AROW System. 516 342-4849 Suffolk County.

Click to request a tax grievance authorization form now. Petition to lower property taxes. ARCNassauCountyNYgov Welcome to AROW Assessment Review on the Web.

A plan to phase in nassau countys reassessment over five years to allow tax hikes to take effect gradually is stalled in the county legislature amid a. How to Challenge Your Assessment. If you mail the form it must be received by the assessor or BAR no later than Grievance Day.

For the last 18 years. In most communities the deadline for submitting Form RP-524 is Grievance Day see below. Many people believe that the municipality officials will actually arrive in person to inspect your home once you file a petition.

Many grievance services seek an authorization in advance of the filing period. After three extensions Nassau Countys 20202021 tax grievance filing deadline has finally passed. New York City residents.

To file an. The New York state sales tax rate is currently 4. Is located on our home page.

All Live ARC Community Grievance Workshops. So if youve grieved on time our advice to you is to pat yourself on the back relax a bit and take a well-deserved break. Processing applications for property tax exemption and the Basic and Enhanced STAR programs for qualifying Nassau County homeowners.

In reality this is very far from the truth. However the property you entered is not located in Nassau County and we only file tax grievances for Nassau County properties. Ad Search Any Address in Nassau County Get A Detailed Property Report Quick.

Rules of Procedure PDF Information for Property Owners. Is there a fee to file a grievance with arc. If you have selected a professional firm such as Maidenbaum to represent your interests you will be periodically notified of the status of your grievance.

New York City Tax Commission. The Nassau County sales tax rate is 425. 631 302-1940 Nassau County.

Nassau Municipality Officials will Show Up at My Home. The Nassau County Department of Assessment offers a property tax appeal process. When Will My Assessment Reduction Appear on My Tax Bills.

This is the total of state and county sales tax rates. All Live ARC Community Grievance Workshops. You may also look up the status of appeals for past tax years.

For specific grievance questions about your property we suggest you contact ARC Customer service at 516-571-3214 or by e-mail at arcnassaucountynygov. Search Nassau County Records Online - Results In Minutes. Nassau County New York sales tax rate details The minimum combined 2021 sales tax rate for Nassau County New York is 863.

TALK TO AN EXPERT NOW. Assessment Challenge Forms Instructions. How To File For A Nassau County Property Tax Grievance Your Online Property Tax Grievance Center For Nassau County Long Island Otherwise you are paying too much in property.

Nassau County residents should file a tax grievance each and every year. For 2022 Have Now Been Completed.

Property Tax Assessment Grievance Workshop Herald Community Newspapers Liherald Com

All The Nassau County Property Tax Exemptions You Should Know About

5 Myths Of The Nassau County Property Tax Grievance Process

Make Sure That Nassau County S Data On Your Property Agrees With Reality

Nassau County Tax Grievance Property Tax Reduction Long Island

Nassau County Property Tax Reduction Tax Grievance Long Island

How To File For A Nassau County Property Tax Grievance Your Online Property Tax Grievance Center For Nassau County Long Island

Nassau County Assessment Review Commission Community Grievance Workshop Youtube

Nassau County District 18 Updates Home Facebook

Nassau County Property Tax Reduction Tax Grievance Long Island

Property Taxes In Nassau County Suffolk County

Nassau County Property Tax 2022 Ultimate Guide To Nassau Property Tax Rates By Town Property Search Payments Due Dates

Tax Grievance Appeal Nassau County Apply Today

Tax Grievance Deadline 2023 Nassau Ny Heller Consultants

Not Sure How To Get A Property Tax Reduction In Nassau County Property Tax Grievance Heller Consultants Tax Grievance

District 16 Arnold W Drucker Nassau County Ny Official Website

Nassau County Grievance Filing On Property Tax Property Tax Grievance Heller Consultants Tax Grievance

How To File For A Nassau County Property Tax Grievance Your Online Property Tax Grievance Center For Nassau County Long Island